Rachael runs a bakery in New York. She set up shop in 2010 with her personal savings and contributions from family and friends, and the business has grown. But Rachael now needs additional financing to open another store. So how does she finance her expansion plans?

Because of stringent requirements, extensive application processes and long turnaround times, small and medium-sized businesses (SMBs) like Rachael’s bakery seldom qualify for traditional bank loans. That’s when alternative lenders — who offer short and easy applications, flexible underwriting and quick turnaround times — come to the rescue.

Alternative lending is any lending that occurs outside of a conventional financial institution. These kinds of lenders offer different types of loans such as lines of credit, microloans and equipment financing, and they use technology to process and underwrite applications quickly. However, given their flexible requirements, they usually charge higher interest rates than traditional lenders.

Securitization is another cost-effective option for raising debt. Lenders can pool the loans they have extended and segregate them into tranches based on credit risk, principal amount and time period.

But how do these lenders raise funds to bridge the financing gap for SMBs?

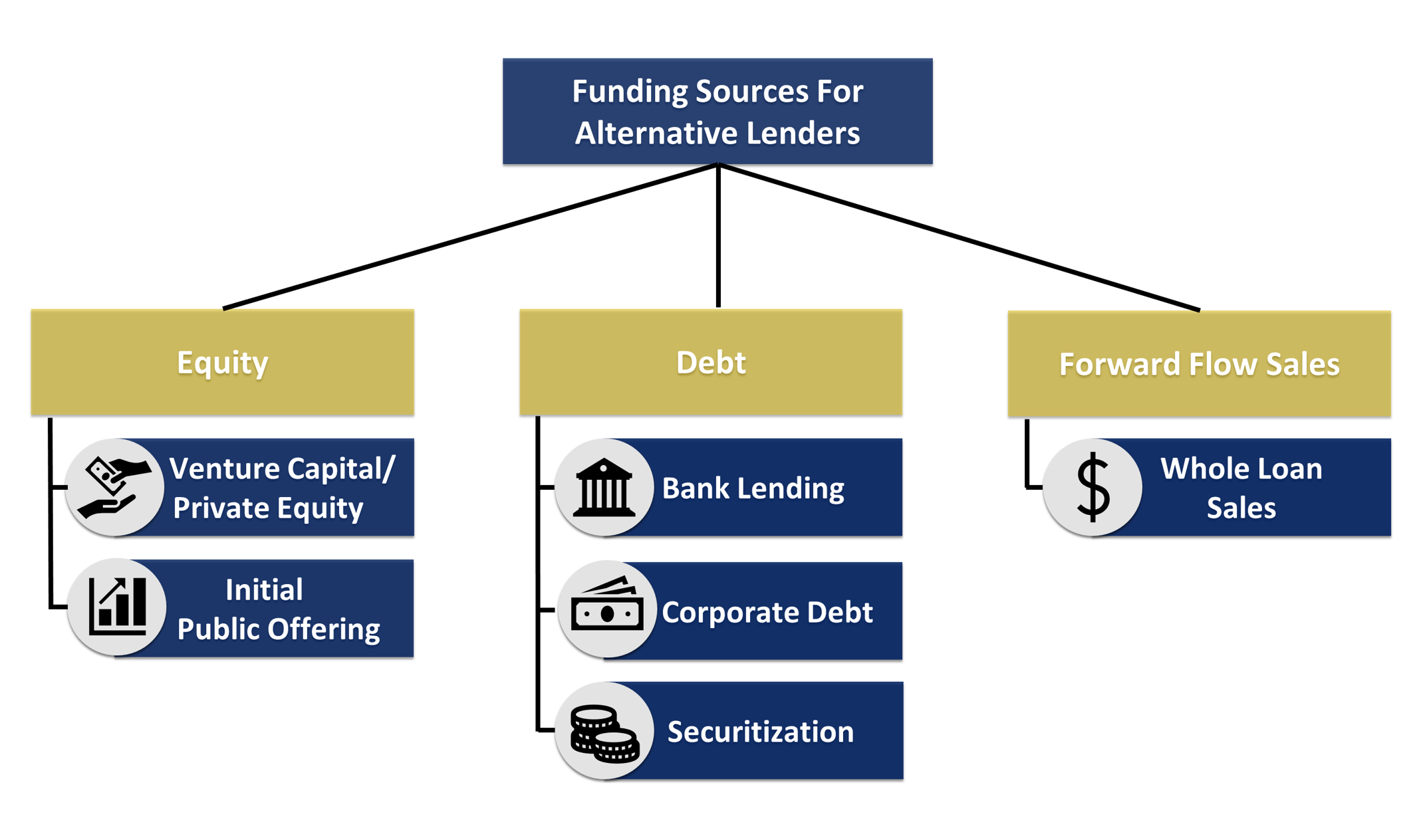

As with all businesses, these firms have two major sources of capital: equity and debt. Alternative lenders typically raise equity funding from venture capital, private equity firms or IPOs, and their debt capital is typically raised from sources such as traditional asset-based bank lending, corporate debt and securitizations.

According to Naren Nayak, SVP and treasurer of Credibly, equity generally constitutes 5% to 25% of capital for alternative lenders, while debt can be between 75% and 95%. “A third source of capital or funding is also available to alternative lenders — whole loan sales — whereby the loans (or merchant cash advance receivables) are sold to institutions on a forward flow basis. This is a “balance-sheet light” funding solution and an efficient way to transfer credit risk for lenders,” he said.

Let’s take a look at each of these options in detail.

Image Credits: FischerJordan

Equity capital

Venture capital or private equity funding is one of the major sources of financing for alternative lenders. The alternative lending industry is said to be a “gold mine” for venture capital investments. While it is difficult for such companies to receive credit from traditional banks because of their stringent requirements in the initial stages, once the founders have shown a commitment by investing their own money, VC and PE firms usually step in.

However, VC and PE firms can be expensive sources of capital — their investment dilutes the ownership and control in the company. Plus, obtaining venture capital is a long, involved and competitive process.

Alternative lenders that have achieved good growth rates and scaled their operations have another option: An IPO lets them quickly raise large amounts of money while providing a lucrative exit for early investors.

source https://techcrunch.com/2021/08/30/lessons-from-covid-flexible-funding-is-a-must-for-alternative-lenders/

0 Comments