When companies create digital payments-facing solutions for African countries outside Nigeria and South Africa, building around mobile money is key. It’s literally a no-brainer.

The concept is ubiquitous in East Africa, but since mobile money is a telecom operators-led initiative, there are technical complexities in creating a unified infrastructure for businesses that need it.

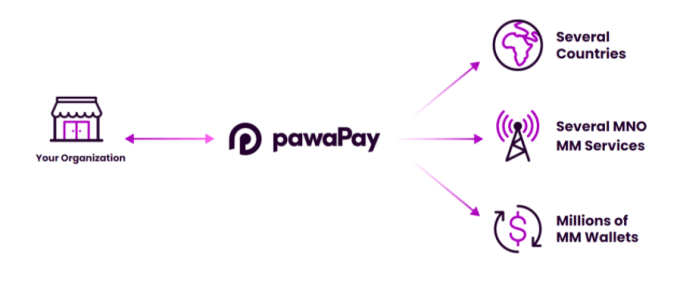

PawaPay, a U.K.-based and Africa-focused payments company, is one of the few tackling these complexities. The company takes the technical integrations from telecom operators like AirtelTigo, Econet, MTN, Safaricom, Orange and Vodafone and collapses them into one API for businesses.

Today, the company is announcing that it has closed $9 million in seed funding to scale its operational presence, recruit talent and expand into new markets.

U.K.-based fund 88mph co-led the round with China-based MSA Capital, with participation from Zagadat Capital, Kepple Ventures and Vunani Capital.

PawaPay spun off last year from online sports betting company betPawa. The company is led by CEO Nikolai Barnwell, betPawa’s former head of New Markets, Africa. He also sits on the board of 88mph.

According to him, starting pawaPay was to help people send and receive money internationally using mobile money.

An interesting instance would be freelancers in Ivory Coast trying to receive payment for services on a global payments platform. Typically, they would be required to use a bank account or card. But in places like Ivory Coast, where mobile money is prevalent, that becomes an issue.

How big is mobile money in Africa?

From the World Bank’s 2015 figures, there are over 350 million unbanked individuals in sub-Saharan Africa. Various inadequacies are responsible for this stat, but from banks’ perspectives, no incentive drives them to actually bank these people.

Most unbanked people rarely earn minimum wage in their respective countries, so it’s difficult for banks to make money off these individuals. Also, opening a bank account involves many KYC (Know Your Customer) processes for this population subset.

But one thing is for sure: The unbanked have mobile phones, and there are over 850 million mobile connections in Africa.

(Photo by Jekesai NJIKIZANA / AFP) (Photo by JEKESAI NJIKIZANA/AFP via Getty Images)

This huge market is why mobile money is prevalent across the continent. Telecom operators using proxies bypassed the banks and created their own systems to allow people to transfer money securely using mobile phones for low or no transfer fees.

So, individuals with phone numbers can have basic financial services such as savings and transfers.

Presently, up to $500 billion flows through the mobile money market in sub-Saharan Africa yearly via the accounts of nearly 300 million active monthly users. This alternative financial infrastructure is one of the largest globally.

But it’s also one of the most underdeveloped because each telecom operator having its own unique mobile money product has created a fragmented infrastructure. For merchants, fragmentation means that it can be exorbitantly expensive to use at scale.

Mobile money and card payment gateways

PawaPay wants to position itself as a market leader in high-volume mobile money payments while delivering reliability and transparency for merchants. Its API allows these merchants to access telecom operators’ mobile money systems to receive and send payments to millions of mobile money accounts.

“We’re making a very heavy bet on the rise of mobile money and all the complexities that arise out of mobile money and all the infrastructure that needs to be built around payments with mobile money at its core,” Barnwell told TechCrunch.

“And the way we’re looking at the continent, we’re looking at adoption rates for mobile money growing at an insane speed. It has become quite obvious that this is a very significant financial infrastructure and there’s a lot of it that’s been missing if you want to work serious volume and businesses on mobile money.”

Image Credits: PawaPay

PawaPay handles local operations, compliance, regulatory cover and bank accounts, making it simple to receive payments in a new market.

The company claims to be handling over 10 million transactions on its rails per week, with beta operations in 10 African countries — Cameroon, DRC, Ghana, Kenya, Mozambique, Nigeria, Rwanda, Tanzania, Uganda, and Zambia.

Barnwell tells TechCrunch that although these transaction volumes look impressive, pawaPay would have done more if not for regulatory hurdles and licensing approaches in each market.

“In each country, we’ve had to start from scratch with the right data to understand how they look at the space, at the licensing sheets, what kind of companies they want to license, what kind of requirements they’re looking for, how we can work quite closely with them to make sure that they’re comfortable with us,” he said.

However, the CEO states that while regulation slows down processes, it’s important for pawaPay because many unregulated companies operate without licenses and unstable technologies, some with the intention to commit fraud.

“We’ve gone in and decided we want to be completely regulated. We want to be completely covered in all the markets, with full licensing and be a very stable reliable premium product in these markets,” he added.

There are various payment gateways facilitating payments for businesses in Africa, like Flutterwave, DPO Group, Yoco, MFS Africa and Paystack. But in terms of pure mobile money play, MFS Africa is a clear competitor to pawaPay. Both platforms are largely focused on addressing the unique challenges accompanying mobile money, while the others drive innovation around bank and card payments.

Image Credits: PawaPay

MFS Africa connects over 300 million mobile money wallets enabling a range of banks, telcos, money transfer operators and other financial institutions interoperability at scale in Africa through a single integration point.

PawaPay isn’t far off. Barnwell says the company connects to nearly the same number of wallets and hopes to go live across 30 to 40 telco integrations soon.

While East Africa (buoyed by Kenya’s M-Pesa) has largely been the critical market for mobile money, West Africa is catching up nicely. Last year, West Africa recorded 198 million mobile money accounts compared to East Africa’s 293 million.

The West African region also grew the most in terms of transaction value by 46%, to over $178 billion, and countries like Ghana, Senegal and Ivory Coast are leading the charge, which presents a vast opportunity for these payment gateway providers, unlike the card payments market where two countries are prominent.

“Although most of the attention is on card payments, the big giant in payments in Africa really is mobile money,” the CEO said.

PawaPay’s mobile money focus was a key reason Kresten Buch, founder of 88mph and chairman of pawaPay, led the round. He said that when 88mph actively invested in Africa a decade ago, “one of the key drivers was that mobile money was a superior payment method to credit and debit cards when used for online payment.”

For Zagadat Capital, here’s what founder Oluwatosin Ajibade (also known as Mr Eazi, a singer-songwriter and entrepreneur popular in Africa’s music scene), who also sits on pawaPay’s board, had to say about the investment:

Being investors hugely focused on Africa and very familiar with the landscape, we believe that mobile money-focused fintech is not just one of the most exciting places to invest but also one of the most important bridges to ensuring financial inclusion of the billions of people across the continent. The kicker for us was that we believe in the clear mission, vision and strategy and we are confident that the pawaPay team is the best team to achieve it.

source https://techcrunch.com/2021/08/26/pawapay-raises-9m-seed-backed-by-msa-88mph-and-mr-eazis-zagadat-capital/

0 Comments